How do venture capital and private equity help to protect assets during high volatility in stock markets?

Key takeaways

- PE/VC ranks #1 by returns

- PE/VC can help improve the diversification of investment portfolios

- PE/VC protects from stock market crises thanks to the weak long-term correlation of VC returns and the stock market

History of VC/PE and its impact on the global economy

Venture capital (VC) and private equity (PE) are investment strategies that can help protect assets during volatile stock market conditions. These asset classes have become increasingly popular in recent years due to their solid returns and ability to diversify investment portfolios.

VC has its roots in the 1960s, with the rise of technology companies such as HP, Intel, and Microsoft. Today, some of the largest companies in the world, like Apple, Microsoft, and Amazon, are VC-backed. On the other hand, PE encompasses a broader range of private assets, including retail chains and factories, which are typically less risky and offer moderate but stable growth.

Venture capital ranks #1 by returns

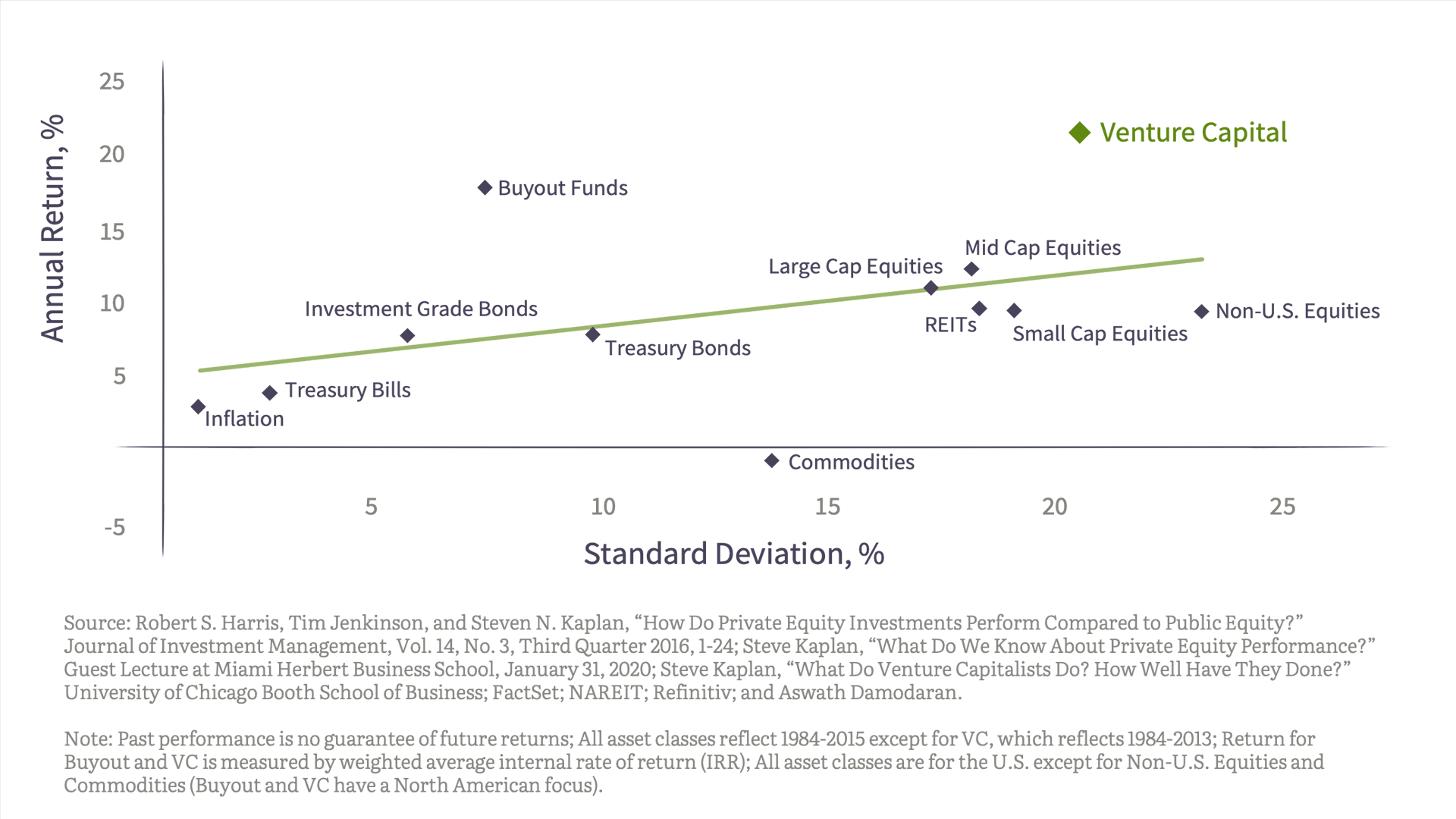

A 2020 report by Morgan Stanley found that VC funds provide the highest returns of all asset classes, while PE and VC funds, generally, have seen a 2x increase in capital raised globally, from $2.4T in 2015 to $5.3T in 2020. Institutional investors, such as pension funds and endowments, have been reallocating their portfolios towards alternative assets like PE and VC, which offer higher returns and lower correlation with public markets.

Figure 1. Risk and reward for asset classes, 1984-2015

VC and PE can help improve the diversification of investment portfolios

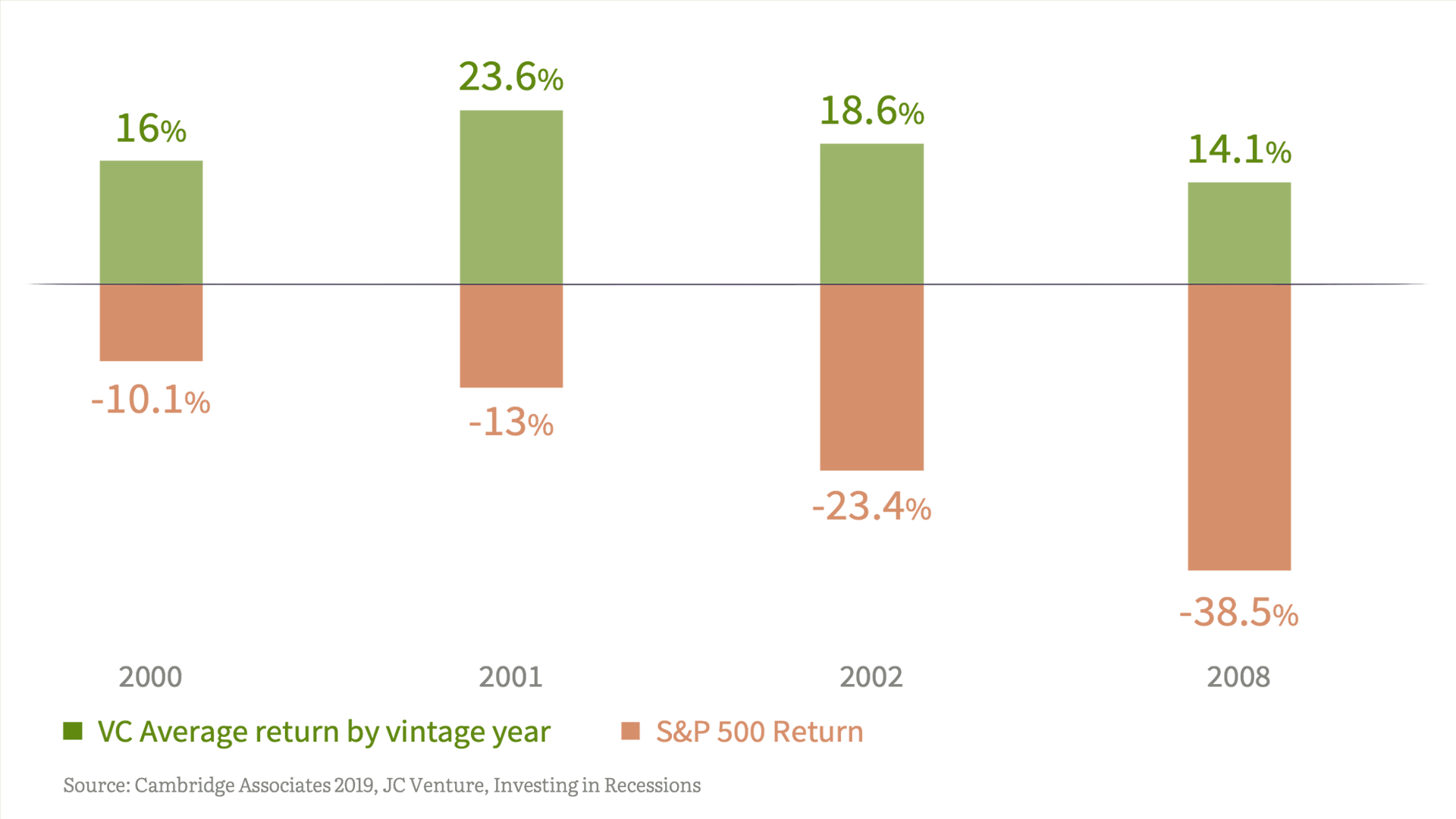

PE and VC investments can improve portfolio diversification by providing returns with a low correlation to other assets. However, it is important to note that these asset classes are less liquid and require careful research and analysis before investing, with a typical investment horizon of 5 to 10 years.

Figure 2. VC has a weak long-term correlation with stock markets, which results in protection from sharp stock decreases and smoother asset performance

Overall, VC and PE offer a promising investment strategy for those seeking long-term protection from financial crises and smooth asset performance.

Sources:

- Morgan Stanley report (2020), where research "How Do Private Equity Investments Perform Compared to Public Equity"

- Cambridge Associates Index

- Nasdaq and S&P Indices

- http://www.electronicsandyou.com/blog/us-top-10-companies-by-market-cap.html

- https://www.statista.com/statistics/263264/top-companies-in-the-world-by-market-capitalization

- Morgan Stanley report (2020)

- BCG 2022: Unlocking the Art of Private Equity in Wealth Management

- Pitchbook — Global VC Deal Activity

- https://medium.com/onevc/is-venture-capital-uncorrelated-with-the-public-equities-market-4fe8fb310760